The Integrated Financial and Human Resource Management System (IFHRMS) is a government initiative in India that helps streamline the management of financial resources and human resources for government employees. It is a critical system that simplifies tasks related to salary, pension, leave, and other financial matters for government employees. One key aspect of IFHRMS is its salary bill processing system, which is vital for both employees and pensioners in India.

If you’re a government employee, understanding how to access and manage your IFHRMS salary bill can help you ensure that your salary is correctly processed, all deductions are made accurately, and your financial details are up to date. This guide will help you understand the entire process of accessing, processing, and troubleshooting your IFHRMS salary bill in simple terms.

What is IFHRMS Salary Bill?

The IFHRMS salary bill refers to the record or document that outlines the salary payments to employees of government departments in India. It includes details like basic salary, allowances, deductions, and net payable salary. The system is designed to automate the calculation of salary and ensure transparency in the payment process.

IFHRMS provides a user-friendly interface where employees can easily access their salary bill and view all details. The goal is to make the salary processing process quick, accurate, and transparent, reducing errors and fraud.

How to Access Your IFHRMS Salary Bill

For any government employee, the ability to access their salary bill is crucial for tracking their earnings and ensuring all deductions are accurate. Here’s how you can access your IFHRMS salary bill.

Step 1: Login to IFHRMS Portal

The first step in accessing your salary bill is logging into the official IFHRMS portal. To do so:

- Visit the official IFHRMS website.

- Enter your user ID and password to log into the system. If you are logging in for the first time, you may need to register or obtain your login credentials from your HR department.

If you forget your password, you can reset it by following the instructions on the login page.

Step 2: Navigate to the Salary Section

Once you are logged in, look for the section related to salary or salary bill. It may be labeled as “Salary and Arrears” or “Employee Salary Details.”

Step 3: Select the Salary Bill for the Desired Month

Most government employees in India receive their salary on a monthly basis. Once you are in the salary bill section, select the month for which you want to view the details. This will open the salary bill for that particular period.

Understanding Your IFHRMS Salary Bill

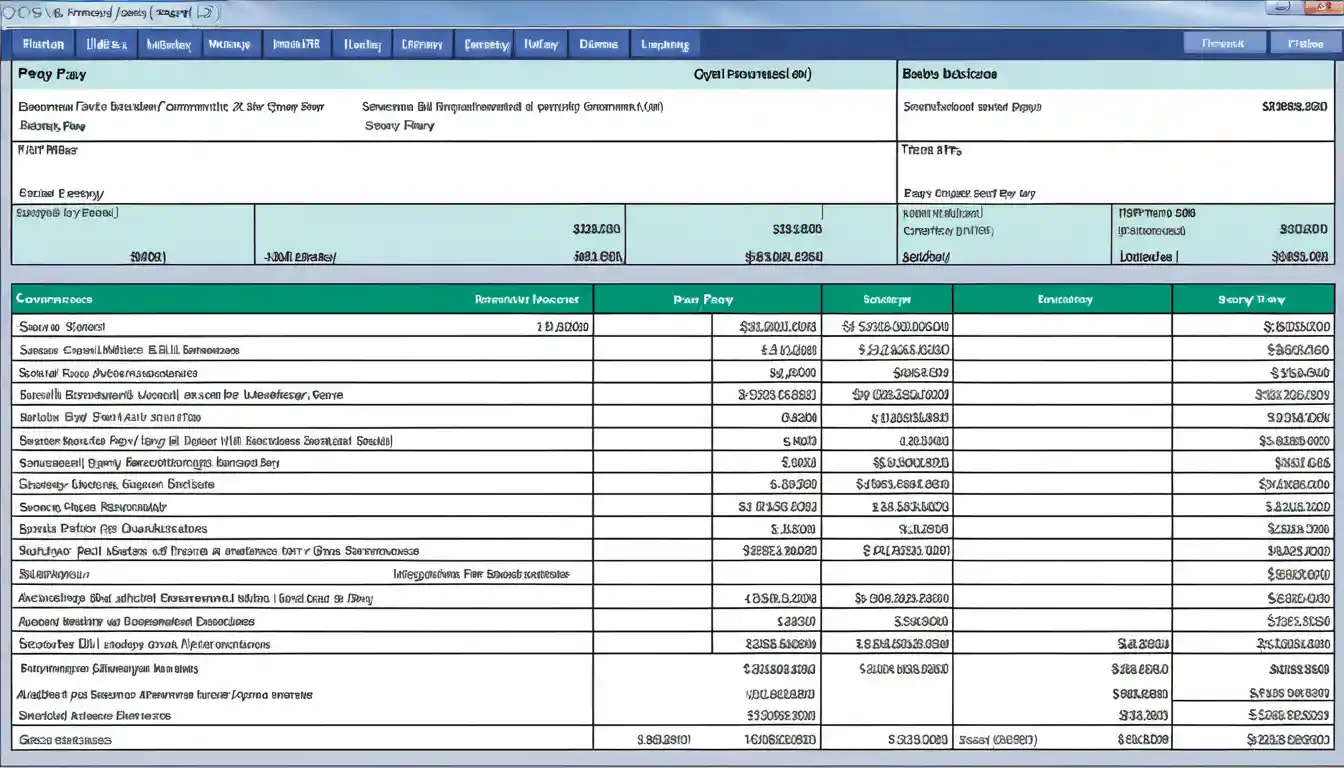

Your IFHRMS salary bill contains several key components. Understanding each of these components can help you verify your salary payments and ensure that everything is correct.

Basic Pay

This is the fixed portion of your salary before any allowances or deductions. It is the starting point of your salary bill.

Allowances

These are the additional amounts added to your salary, such as house rent allowance (HRA), dearness allowance (DA), or travel allowance. These amounts vary depending on your role and location in India.

Deductions

Deductions can include tax deductions at source (TDS), provident fund (PF) contributions, and insurance. These are subtracted from your total salary.

Net Pay

This is the final amount you will receive after all allowances and deductions are added or subtracted. Your net pay is the salary that is credited to your bank account.

How to Process Your IFHRMS Salary Bill

For many employees in India, processing the salary bill might seem complex. However, it is an automated process within the IFHRMS system, which makes it relatively straightforward.

Step 1: Ensure Correct Data Entry

Before your salary is processed, it’s important to ensure that all your personal details, including your bank account information, allowances, and deductions, are correctly entered into the system. This ensures that your salary bill is calculated accurately.

Step 2: Submit Your Salary Bill for Approval

Once your salary bill details are entered, your supervisor or HR department will review and approve them. This step ensures that all calculations are correct and that your bill complies with government policies.

Step 3: Payment Processing

Once approved, your salary bill is processed and payments are made. If you’re using IFHRMS, your salary should be credited directly to your bank account without any delays.

Step 4: Download the Salary Bill

After your salary is processed, you can download your salary bill directly from the IFHRMS portal. This provides a detailed breakdown of your salary, deductions, and net pay for your records.

Troubleshooting IFHRMS Salary Bill Issues

While the IFHRMS system is designed to be user-friendly, you may face some issues when accessing or processing your salary bill. Below are some common problems and troubleshooting steps.

IFHRMS Login Issues

If you are unable to log in to the IFHRMS portal, it could be due to incorrect login credentials, a forgotten password, or a system glitch.

Solution:

- Double-check your user ID and password.

- Use the “Forgot Password” link to reset your password.

- If you still face issues, contact the IT support team or HR department for assistance.

Incorrect Salary Details

If your salary bill contains incorrect details, such as wrong deductions or allowances, it could be due to data entry errors in the system.

Solution:

- Check your personal details in the IFHRMS portal to ensure that all information is accurate.

- Contact your HR department to fix any discrepancies.

Salary Payment Delays

Sometimes, the salary bill might be processed but delayed in payment. This could be due to banking issues or errors in the payment processing system.

Solution:

- Contact your bank to verify if there are any issues with your account.

- Reach out to your HR department or the IFHRMS help desk for assistance in resolving the issue.

Benefits of Using IFHRMS for Salary Bill Processing

Using the IFHRMS salary bill system offers several benefits for government employees in India:

Transparency: The system ensures that all calculations are done correctly, reducing errors.

Efficiency: The automated process speeds up salary processing and reduces manual work.

Convenience: Employees can access their salary bill anytime from anywhere, making it easy to track payments.

Security: IFHRMS provides secure access to your financial information, protecting your salary details from unauthorized access.